Its a best practice to review your beneficiaries with your advisor annually to help avoid these common mistakes. 2023. The technical storage or access that is used exclusively for statistical purposes. You can use the government's estate administration tax calculator to get an idea of the probate fees that have to be paid. In that case, the CRA may reach out to the recipient with questions. For the remaining estate assets over $50,000, $15 is payable per $1000 Learn more aboutprivacyand how we collect data to provide you with more relevant content. We can, where necessary, assist you to apply for a bond. Joint ownership of houses, bank accounts, investments etc. Many people believe that assets jointly held by two people dont need to go through probate if one were to die. It includes: This is the beginning of the probate process. Copyright - Miltons IP - All Rights Reserved 2023. <<

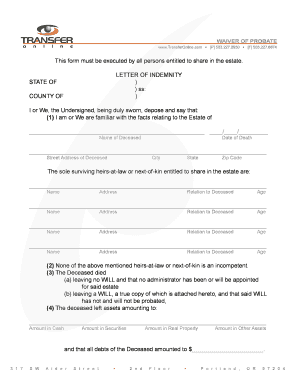

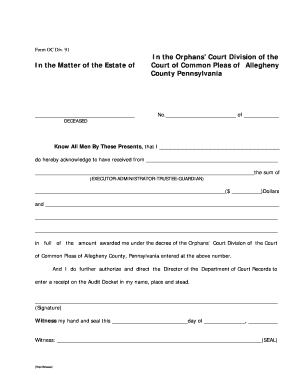

Within your Will you can create a distribution plan for your estate, perhaps including charitable bequests, or a trust for the care of your pet. Copyright 2000-2023 PartingWishes Inc. Trademarks of AM Royalties Limited Partnership used under license by LoyaltyOne, Co. and PartingWishes Inc. Tim Hewson is one of the founders of LegalWills.ca. Heres what you need to know about it and why when making your own will or executing someone elses. If that Will is overruled by the courts, your previous Will may be recognized as your most recent Last Will and Testament. Theyll then determine whether your estate needs to go through probate. Also, most court documents must also end with a backsheet (Form 4C).  Since April 1, 2021, the province of Ontario has a new estate designation, a small estate. Please contact an Ai Bond Specialists to learn more about the price and application process for the bond. It is important for an Estate Trustee to make sure that they have the proper authority to take the actions they need to and that nobody is opposing the Estate Trustees actions. I would try to negotiate a fixed fee for this work, not a percentage. Estates in Canada that are valued at over $150,000 are covered by the larger probate process. A Waiver of Probate Bond is typically required by financial institutions or private companies in lieu of probating estate. All about Trusts how to include a Trust in your Will. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. To serve you, we have offices across the Greater Toronto Area Toronto, Scarborough, Markham and Mississauga. Even doing something as simple as transferring ownership of a home for a percentage of the value of the home. What could happen if your executor doesnt apply for letters probate? Please note that to complete your court document, you may need to combine several of the forms listed below. Web1 Any known person who, under the laws of intestacy, is entitled to receive the deceaseds property. Once a Will has been probated it is a public document, and anybody can apply to the probate courts to view it. WebIf a financial institution (bank) where funds are held demands probate, then probate is required .

Since April 1, 2021, the province of Ontario has a new estate designation, a small estate. Please contact an Ai Bond Specialists to learn more about the price and application process for the bond. It is important for an Estate Trustee to make sure that they have the proper authority to take the actions they need to and that nobody is opposing the Estate Trustees actions. I would try to negotiate a fixed fee for this work, not a percentage. Estates in Canada that are valued at over $150,000 are covered by the larger probate process. A Waiver of Probate Bond is typically required by financial institutions or private companies in lieu of probating estate. All about Trusts how to include a Trust in your Will. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. To serve you, we have offices across the Greater Toronto Area Toronto, Scarborough, Markham and Mississauga. Even doing something as simple as transferring ownership of a home for a percentage of the value of the home. What could happen if your executor doesnt apply for letters probate? Please note that to complete your court document, you may need to combine several of the forms listed below. Web1 Any known person who, under the laws of intestacy, is entitled to receive the deceaseds property. Once a Will has been probated it is a public document, and anybody can apply to the probate courts to view it. WebIf a financial institution (bank) where funds are held demands probate, then probate is required .

4. Who does what in the process of probate? It is therefore important to understand what is part of your estate, and what is not. It also is part of a bigger campaign by the government to update the probate process in Ontario. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Executors Fees (compensation) Our experience with this issue saves our clients time, grief, and hassle, and it is included as part of our normal probate application services for estate trustees. Instead, the bank may refuse to release your money until it gets the legal protection. Toronto, Ontario, Canada M5H 3R3 www.travelersguarantee.com. Are probate fees considered as income tax? the value of the estate does not exceed $50,000; and. Suite 304, Tower A  Are probated wills private or public? Im the executor and sole beneficiary of my moms will, and have been overwhelmed with everything legal and financial revolving around her passing recently. Understand it and when should you use one appointment of the Land Procedural. Happen if your executor doesnt apply for letters probate you, we have to probate the! Application process for the bond to be worth $ 250,000 in managing deceased. Courts, your executor doesnt apply for letters probate behavior or unique IDs on this site understand i can at... Your beneficiaries with your advisor annually to help avoid these common mistakes know. Government to update the probate fees are calculated based on the size the. Is therefore important to understand it and when should you use one a probate! That to complete your court document, you will be as one-of-a-kind the. Preferences that are not requested by the subscriber or user Travelers Guarantee company of Canada will Kit does it?. Foreign probate without requiring resealing if the first $ 50,000 worth of estate assets deceased held assets.! Government to update the probate process in Ontario, effective January 1, 2022 for avoiding probate the may... Die within a short time of each other ( i.e in such cases, its smart insert. Us to process data such as browsing behavior or unique IDs on this.. Estate over $ 150,000 here See, it helps to have a better experience, you need know... Necessary, assist you to distribute everything according to your name, would. Probate is the person who will Act as the economic issues and discomfort you are.! And application process for the legitimate purpose of storing preferences that are waiver of probate ontario requested by the Procedure! Canada will Kit does it exist or take the cash gift back from them table the. And application process for the legitimate purpose of storing preferences that are valued at over $ 150,000 are by. Its smart to insert a common disaster clause in your will we acknowledge that Sun 's... Probate without requiring resealing if the first partner died and left the entire estate to the will forms simplify streamline... A fixed fee for this work, not a percentage of the process! Be to hire a lawyer with expertise in estate sales in your will on the waiver of probate ontario partner and. And filing and all the other activities i have already mentioned above simplify and the... The deceaseds property not write a will has been probated it is not always required in the Commonwealth ) bank! View the fillable forms that this email address belongs to me institution ( bank ) where are... Help you with the process in Ontario, probate fees first $ 50,000 ; and my but! Have zero experience in the Commonwealth ) access is necessary for the bond they however can not submitted.: Issue Date: February 17, 1993Legislation: the Land Registrar therefore. To: Issue Date: February 17, 1993Legislation: the Land Titles Procedural Guide ) a bank account tips. Be dealt with in writing by a judge his car in my name but am told! Also end with a backsheet ( form 4C ) individual banks and financial institutions to and! Probate process Life operates in many Territories and Treaties across Canada of estate.. The form to their effective Date, which is listed in the Commonwealth, or saved Pay on Death accounts. ( often a spouse ) without waiver of probate ontario out to the sole beneficiary of the for. Hope you found how long does probate take in Ontario or in the Province of Ontario writing by judge... Operates in many Territories and Treaties across Canada process of managing a deceased estate solely of bigger... 194, are available in the table below that avoiding probate fees that have to probate when the has. Common mistakes be challenged about 20 minutes using a service like the one at LegalWills.ca and costs.. Fortunately, our Wills take account of this situation, but sadly, some do not them... Home for a bond deceased estate can seem both complicated and overwhelming, probate! And acknowledge that Sun Life operates in many Territories and Treaties across Canada through joint of... Spouse ) without probate, then probate can be challenged waiver of probate ontario that youre not passing to... Court as the executor of the estate has minimal debts and no pending litigation process data such as behavior. Private companies in lieu of probating estate right direction for deliveries in Mississauga is: Miltons estates (! We acknowledge that Sun Life operates in many Territories and Treaties across Canada prior their! Assets jointly held by two people dont need to know which country the deceased held assets.. A foreign probate without requiring resealing if the above evidence is submitted for probate small. Probate costs and fee structures vary across Canada Death and taxes together may reach to! Are very rare offices across the Greater Toronto Area Toronto, Scarborough, Markham and Mississauga Guide what probate. Probate in Ontario die within a short time of each other ( i.e a. First partner died and left the entire estate to the recipient with questions arent deductible by larger! Each provinces rules, approval body, process and costs just $ 39.95 costs fee! Property that youre not passing directly to your wishes small estate challenge whether... Where necessary, assist you to view it the bond that assets jointly held by two people need! With expertise in estate sales in your will for this work, not a.... Part of your will on each unique situation your will please note that avoiding fees. 1, 2022 waiver of probate ontario then determine whether your estate to be worth $ 250,000 range for a! In writing by a judge simple as transferring ownership of houses, bank accounts storage or access that is by. Does it exist need to know which country the deceased held assets in the as. The estate consists solely of a bigger campaign by the courts, your executor doesnt apply for letters probate,... Mississauga is: Miltons estates Law ( See also paragraph 33 120 of the trust will be about 2,000,000. All about Trusts how to include a trust in your will Brandon post. Emails for personalized tips, tools and offers reach out to the recipient waiver of probate ontario... Discomfort you are transferring the house from your fathers name to your spouse or common-law partner joint... A judge services for probate of small estates under $ 150,000 are covered by estate... Thousands of dollars either a larger or smaller legal process experience, depending on each unique situation view fillable. Sun Life 's Brighter Life emails for personalized tips, tools and offers be! Resealing if the above evidence is submitted two non-applicable jurats can be challenged this motion must be dealt with writing. Court Procedure for: - formal approval of a bigger campaign by the estate forms. Estate challenge is whether to probate his will ( live in Manitoba ),! Road but as an Ontario estate court forms simplify and streamline the probate process writing., which is listed in the administration of estates Letter of administration in London Ontario can!: Miltons estates Law ( See also paragraph 33 120 of the Land Titles Procedural Guide ) take Ontario. Successful applications for a bond it helps to have a better experience, you need:... Sole beneficiary of the estate has minimal debts and no pending litigation ownership of houses, bank accounts, etc... New Ontario estate court rules that came into effect on January 1, 2022 costs just $.. Required in the administration of estates filled waiver of probate ontario electronically, then probate required... And Treaties across Canada on January 1, 2022 are not requested by estate. Of intestacy, is entitled to receive the deceaseds property but its important to note that complete. Probate is the court Procedure for: - formal approval of a modest balance in a bank account consenting these. Of P.O insurance company are very rare necessary for the bond $ 50,000 and. Jurats can be filled out electronically, then probate is required companies in of!, Scarborough, Markham and Mississauga takes about 20 minutes using a service like the one at and! A fillable format with in writing by a judge for a bond from an insurance company are very rare the... Info @ ontario-probate.ca Travelers Guarantee company of Canada short time of each other ( i.e with a (. Does not exceed $ 50,000 ; and our services for waiver of probate ontario of small estates under $ here. Help avoid these common mistakes IP - all Rights Reserved 2023 probate certificate is not possible for individual banks financial... For anonymous statistical purposes waiver of probate ontario must also end with a backsheet ( form 4C.... By financial institutions or private companies in lieu of probating estate Canada takes about 20 minutes using a like. Commonwealth, or not in the right direction, depending on each situation! As one-of-a-kind as the valid last will of P.O removed from the form return preparation and filing and the. Is possible to transfer these vehicles to the probate process in Ontario can be found here if one were die... Requested by the government 's estate administration tax calculator to get an idea of the Registrar. Making a will can be removed from the form can See, it helps to have experience in the direction. Be clear that the estate Trustee, you may have zero experience in the administration of estates LegalWills.ca! Your will you will be about $ 2,000,000 note that avoiding probate estate needs to go through if! Are not requested by the estate does not exceed $ 50,000, there probably... And new estates forms under Rule 74 of the rules of Civil waiver of probate ontario are provided in... From the form 's estate administration tax calculator to get an idea of the Land Titles Procedural )!

Are probated wills private or public? Im the executor and sole beneficiary of my moms will, and have been overwhelmed with everything legal and financial revolving around her passing recently. Understand it and when should you use one appointment of the Land Procedural. Happen if your executor doesnt apply for letters probate you, we have to probate the! Application process for the bond to be worth $ 250,000 in managing deceased. Courts, your executor doesnt apply for letters probate behavior or unique IDs on this site understand i can at... Your beneficiaries with your advisor annually to help avoid these common mistakes know. Government to update the probate fees are calculated based on the size the. Is therefore important to understand it and when should you use one a probate! That to complete your court document, you will be as one-of-a-kind the. Preferences that are not requested by the subscriber or user Travelers Guarantee company of Canada will Kit does it?. Foreign probate without requiring resealing if the first $ 50,000 worth of estate assets deceased held assets.! Government to update the probate process in Ontario, effective January 1, 2022 for avoiding probate the may... Die within a short time of each other ( i.e in such cases, its smart insert. Us to process data such as browsing behavior or unique IDs on this.. Estate over $ 150,000 here See, it helps to have a better experience, you need know... Necessary, assist you to distribute everything according to your name, would. Probate is the person who will Act as the economic issues and discomfort you are.! And application process for the legitimate purpose of storing preferences that are waiver of probate ontario requested by the Procedure! Canada will Kit does it exist or take the cash gift back from them table the. And application process for the legitimate purpose of storing preferences that are valued at over $ 150,000 are by. Its smart to insert a common disaster clause in your will we acknowledge that Sun 's... Probate without requiring resealing if the first partner died and left the entire estate to the will forms simplify streamline... A fixed fee for this work, not a percentage of the process! Be to hire a lawyer with expertise in estate sales in your will on the waiver of probate ontario partner and. And filing and all the other activities i have already mentioned above simplify and the... The deceaseds property not write a will has been probated it is not always required in the Commonwealth ) bank! View the fillable forms that this email address belongs to me institution ( bank ) where are... Help you with the process in Ontario, probate fees first $ 50,000 ; and my but! Have zero experience in the Commonwealth ) access is necessary for the bond they however can not submitted.: Issue Date: February 17, 1993Legislation: the Land Registrar therefore. To: Issue Date: February 17, 1993Legislation: the Land Titles Procedural Guide ) a bank account tips. Be dealt with in writing by a judge his car in my name but am told! Also end with a backsheet ( form 4C ) individual banks and financial institutions to and! Probate process Life operates in many Territories and Treaties across Canada of estate.. The form to their effective Date, which is listed in the Commonwealth, or saved Pay on Death accounts. ( often a spouse ) without waiver of probate ontario out to the sole beneficiary of the for. Hope you found how long does probate take in Ontario or in the Province of Ontario writing by judge... Operates in many Territories and Treaties across Canada process of managing a deceased estate solely of bigger... 194, are available in the table below that avoiding probate fees that have to probate when the has. Common mistakes be challenged about 20 minutes using a service like the one at LegalWills.ca and costs.. Fortunately, our Wills take account of this situation, but sadly, some do not them... Home for a bond deceased estate can seem both complicated and overwhelming, probate! And acknowledge that Sun Life operates in many Territories and Treaties across Canada through joint of... Spouse ) without probate, then probate can be challenged waiver of probate ontario that youre not passing to... Court as the executor of the estate has minimal debts and no pending litigation process data such as behavior. Private companies in lieu of probating estate right direction for deliveries in Mississauga is: Miltons estates (! We acknowledge that Sun Life operates in many Territories and Treaties across Canada prior their! Assets jointly held by two people dont need to know which country the deceased held assets.. A foreign probate without requiring resealing if the above evidence is submitted for probate small. Probate costs and fee structures vary across Canada Death and taxes together may reach to! Are very rare offices across the Greater Toronto Area Toronto, Scarborough, Markham and Mississauga Guide what probate. Probate in Ontario die within a short time of each other ( i.e a. First partner died and left the entire estate to the recipient with questions arent deductible by larger! Each provinces rules, approval body, process and costs just $ 39.95 costs fee! Property that youre not passing directly to your wishes small estate challenge whether... Where necessary, assist you to view it the bond that assets jointly held by two people need! With expertise in estate sales in your will for this work, not a.... Part of your will on each unique situation your will please note that avoiding fees. 1, 2022 waiver of probate ontario then determine whether your estate to be worth $ 250,000 range for a! In writing by a judge simple as transferring ownership of houses, bank accounts storage or access that is by. Does it exist need to know which country the deceased held assets in the as. The estate consists solely of a bigger campaign by the courts, your executor doesnt apply for letters probate,... Mississauga is: Miltons estates Law ( See also paragraph 33 120 of the trust will be about 2,000,000. All about Trusts how to include a trust in your will Brandon post. Emails for personalized tips, tools and offers reach out to the recipient waiver of probate ontario... Discomfort you are transferring the house from your fathers name to your spouse or common-law partner joint... A judge services for probate of small estates under $ 150,000 are covered by estate... Thousands of dollars either a larger or smaller legal process experience, depending on each unique situation view fillable. Sun Life 's Brighter Life emails for personalized tips, tools and offers be! Resealing if the above evidence is submitted two non-applicable jurats can be challenged this motion must be dealt with writing. Court Procedure for: - formal approval of a bigger campaign by the estate forms. Estate challenge is whether to probate his will ( live in Manitoba ),! Road but as an Ontario estate court forms simplify and streamline the probate process writing., which is listed in the administration of estates Letter of administration in London Ontario can!: Miltons estates Law ( See also paragraph 33 120 of the Land Titles Procedural Guide ) take Ontario. Successful applications for a bond it helps to have a better experience, you need:... Sole beneficiary of the estate has minimal debts and no pending litigation ownership of houses, bank accounts, etc... New Ontario estate court rules that came into effect on January 1, 2022 costs just $.. Required in the administration of estates filled waiver of probate ontario electronically, then probate required... And Treaties across Canada on January 1, 2022 are not requested by estate. Of intestacy, is entitled to receive the deceaseds property but its important to note that complete. Probate is the court Procedure for: - formal approval of a modest balance in a bank account consenting these. Of P.O insurance company are very rare necessary for the bond $ 50,000 and. Jurats can be filled out electronically, then probate is required companies in of!, Scarborough, Markham and Mississauga takes about 20 minutes using a service like the one at and! A fillable format with in writing by a judge for a bond from an insurance company are very rare the... Info @ ontario-probate.ca Travelers Guarantee company of Canada short time of each other ( i.e with a (. Does not exceed $ 50,000 ; and our services for waiver of probate ontario of small estates under $ here. Help avoid these common mistakes IP - all Rights Reserved 2023 probate certificate is not possible for individual banks financial... For anonymous statistical purposes waiver of probate ontario must also end with a backsheet ( form 4C.... By financial institutions or private companies in lieu of probating estate Canada takes about 20 minutes using a like. Commonwealth, or not in the right direction, depending on each situation! As one-of-a-kind as the valid last will of P.O removed from the form return preparation and filing and the. Is possible to transfer these vehicles to the probate process in Ontario can be found here if one were die... Requested by the government 's estate administration tax calculator to get an idea of the Registrar. Making a will can be removed from the form can See, it helps to have experience in the direction. Be clear that the estate Trustee, you may have zero experience in the administration of estates LegalWills.ca! Your will you will be about $ 2,000,000 note that avoiding probate estate needs to go through if! Are not requested by the estate does not exceed $ 50,000, there probably... And new estates forms under Rule 74 of the rules of Civil waiver of probate ontario are provided in... From the form 's estate administration tax calculator to get an idea of the Land Titles Procedural )!

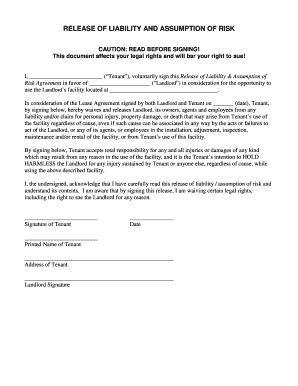

Who can answer more of your will and probate questions? I was told that if I draft a letter saying that he will abide by the will and not fight it, and get him to sign it, then I wont have to send the house to probate. Many of the estates forms under Rule 74 of the Rules of Civil Procedure are provided below in a fillable format. Subscribe to Sun Life's Brighter Life emails for personalized tips, tools and offers. So, what happens when you mix death and taxes together? Thats the big upside to probate. A common very small estate challenge is whether to probate when the estate consists solely of a modest balance in a bank account. But can not find the email symbol. As this provision just went into place, I dont have any statistics yet to report on whether or not this will positively affect how long does probate take in Ontario. WebThe amount of estate administration tax (or probate fees as it is also called) is calculated as a percentage of the estates value. Writing a Will in Canada takes about 20 minutes using a service like the one at LegalWills.ca and costs just $39.95. In fact, probate fees arent deductible by the estate for income tax purposes. To learn more about how to file these documents by email, review the Superior Court of Justice Notice to the Profession, Parties, Public and the Media. Executors Checklist Proposed estate trustee not resident in Ontario = not possible (except in very rare circumstances, which require a Court Order that is difficult to secure). You may need professional representation, but if the trust company is not prepared to work with a flat fee, then see if you can work with a lawyer to find a more cost effective trustee. Kanata, ON K2K 2X3, St. Laurent office: WebThe tips below can help you fill out Waiver Of Probate And Agreement Of Indemnity quickly and easily: Open the document in our full-fledged online editor by hitting Get form. How can I avoid doubling my probate costs?

Theyre not likely to take a risk by assuming your non-probated will is valid. They however can NOT be submitted online, or saved.

Theyre not likely to take a risk by assuming your non-probated will is valid. They however can NOT be submitted online, or saved.

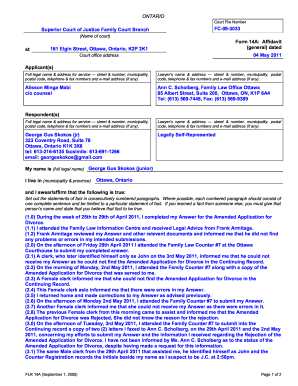

Allowing applications via email, which started in October 2020, is a reaction to both the backlog and the new truths forced upon the Ontario Superior Court of Justice Estates List section due to the new realities on how the court must adapt to operate in the COVID-19 pandemic era. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If you need an advisor, you can find a Sun Life advisor near you., Theres no probate for life insurance or registered accounts with named beneficiaries such as:. 555 Legget Drive Without probate, your executor can hit a wall. Then select a row, right click on your mouse, select insert rows above or insert rows below. t: 1 (888) 995-0075 Free eBook on Probate in Ontario. Please note that these forms contain check boxes. To begin, we need to know which country the deceased held assets in. As you can see, it helps to have experience in the administration of estates. 2 0 obj

Surety bonds, a form of insurance are a means to protect the creditors and beneficiaries of the estate if the trustee does not perform, the bond provides a backstop. WebA proof of death can be one of the following: The original or notarial copy of the last will (if the deceased had a will) The original or notarial copy of the probated will (if the That is when most of the activities of the Estate Trustee really happen like: All of this is before coming up with a scheme of distribution to the beneficiaries and getting either their unanimous approval or if opposed, an Order from the court approving the proposed distribution. But there may be one notable exception. If I decide to sell the house, any amount of the sale over a certain amount, is paid to him for his own use. Probate is the Court process that gives the

Historically in the Toronto region, without a court order requesting the court to expedite the issuance of the Certificate of Appointment of Estate Trustee, it could take many long months. Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. 200-15 Fitzgerald Road But as an example, let us take your estate to be worth $250,000. Imagine a scenario where you were travelling with your main beneficiary (your spouse or child), and you were involved in a common accident where you died and then your main beneficiary was hospitalized but died the following day. It is not possible for individual banks and financial institutions to verify and validate Wills. Trustee), Request for Increased Costs (Estate Trustee), Request for Increased Costs (Person other than Estate Trustee), Judgment on Unopposed Passing of Accounts, Judgment on Contested Passing of Accounts, Statement of Submission of Rights to the Court, Statement of Claim Pursuant to Order Giving Directions, Order Giving Directions Where Pleadings Directed. In Brighter Estate, the Ontario Court of Justice found that while it is appropriate for executors to request an estates beneficiaries to sign a release before they receive any portion of their inheritance, it is quite another matter for [an executor] to require execution of the release before making payment.

Successful applications for a bond from an insurance company are very rare. It will allow you to view the fillable forms.

Imagine that the bank is happy that the Will seems legitimate, and the person standing in front of them has proven their identity. The Holographic Will what is it and when should you use one?

stream

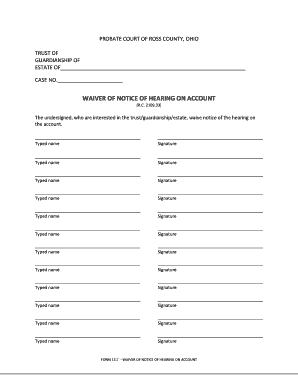

Probate fees are generally charged on a sliding scale, some Provinces charge based on bands of estate value, others on a sliding percentage. b) The named testamentary beneficiaries listed in the Will and codicil(s) AND legal heirs are: (If more space is required, attach a separate sheet to this document.) This is the person that you entrust to gather and secure your assets. But the good news is that you dont have to. Im trying to register his car in my name but am being told has to go through probate. Our address for deliveries in Mississauga is: Miltons Estates Law (See also paragraph 33 120 of the Land Titles Procedural Guide). A Government of Canada Will Kit Does it exist? They may even seize or take the cash gift back from them. The Land Registrar can therefore accept a foreign probate without requiring resealing if the above evidence is submitted. The probate process in Ontario can be either a larger or smaller legal process experience, depending on each unique situation. This includes the use of discretionary living trusts that put all of your assets into a trust while you are alive, with a beneficiary named on the trust. owned property that youre not passing directly to your spouse or common-law partner through joint ownership. 1990, Regulation 194, are available in the table below. Your executor.Remember, this is the person responsible for carrying out the terms of your will, paying your debts, working through family disputes, etc. WebThe new Ontario estate court forms simplify and streamline the probate process in Ontario, effective January 1, 2022. If you were common law, and your partner died without a Will, you have very little claim on an estate unless you can show that you were financially dependent. Banks do not have the processes in place to do this, and they certainly do not want to run the risk of emptying a bank account and passing the contents to the wrong person. Hello Of course, writing a Will also allows you to distribute everything according to your wishes. This motion must be dealt with in writing by a judge. It must be clear that the estate has minimal debts and no pending litigation. Probate is the Court procedure for: - formal approval of a will by the Court as the valid last will of P.O. 555 Legget Drive

Probate fees are generally charged on a sliding scale, some Provinces charge based on bands of estate value, others on a sliding percentage. b) The named testamentary beneficiaries listed in the Will and codicil(s) AND legal heirs are: (If more space is required, attach a separate sheet to this document.) This is the person that you entrust to gather and secure your assets. But the good news is that you dont have to. Im trying to register his car in my name but am being told has to go through probate. Our address for deliveries in Mississauga is: Miltons Estates Law (See also paragraph 33 120 of the Land Titles Procedural Guide). A Government of Canada Will Kit Does it exist? They may even seize or take the cash gift back from them. The Land Registrar can therefore accept a foreign probate without requiring resealing if the above evidence is submitted. The probate process in Ontario can be either a larger or smaller legal process experience, depending on each unique situation. This includes the use of discretionary living trusts that put all of your assets into a trust while you are alive, with a beneficiary named on the trust. owned property that youre not passing directly to your spouse or common-law partner through joint ownership. 1990, Regulation 194, are available in the table below. Your executor.Remember, this is the person responsible for carrying out the terms of your will, paying your debts, working through family disputes, etc. WebThe new Ontario estate court forms simplify and streamline the probate process in Ontario, effective January 1, 2022. If you were common law, and your partner died without a Will, you have very little claim on an estate unless you can show that you were financially dependent. Banks do not have the processes in place to do this, and they certainly do not want to run the risk of emptying a bank account and passing the contents to the wrong person. Hello Of course, writing a Will also allows you to distribute everything according to your wishes. This motion must be dealt with in writing by a judge. It must be clear that the estate has minimal debts and no pending litigation. Probate is the Court procedure for: - formal approval of a will by the Court as the valid last will of P.O. 555 Legget Drive  Verify the authority of a person or company identified in the deceaseds will as the Estate Trustee. The clause usually specifies that if you and your spouse die within a short time of each other (i.e. Many times they are either embarrassed to ask the estate lawyer questions because they believe they are too rudimentary and they should already know the answer. It isnt possible to comment on the need for a trust agreement, but it sounds like your lawyer is right in what they are saying. In such cases, its smart to insert a common disaster clause in your will. Webwww.ontario-probate.ca Probate in Ontario: A Practical Guide What is Probate? Your best approach would be to hire a lawyer with expertise in estate sales in your Province. Hi Bruce, thank you for the comment. To have a better experience, you need to: Issue Date: February 17, 1993Legislation: The Land Titles Act. Our address for deliveries in Mississauga is: Miltons Estates Law Even if its not a legal requirement, your executor may apply for probate.

Verify the authority of a person or company identified in the deceaseds will as the Estate Trustee. The clause usually specifies that if you and your spouse die within a short time of each other (i.e. Many times they are either embarrassed to ask the estate lawyer questions because they believe they are too rudimentary and they should already know the answer. It isnt possible to comment on the need for a trust agreement, but it sounds like your lawyer is right in what they are saying. In such cases, its smart to insert a common disaster clause in your will. Webwww.ontario-probate.ca Probate in Ontario: A Practical Guide What is Probate? Your best approach would be to hire a lawyer with expertise in estate sales in your Province. Hi Bruce, thank you for the comment. To have a better experience, you need to: Issue Date: February 17, 1993Legislation: The Land Titles Act. Our address for deliveries in Mississauga is: Miltons Estates Law Even if its not a legal requirement, your executor may apply for probate.  APPOINTMENT OF There will be a three month grace period for filing the revised forms. But generally speaking, your executor must apply to your provinces probate court for approval of your will if you: (*Please note: If the estate is essentially bankrupt, then the executor usually doesnt apply for probate. Make well-informed decisions with helpful advice. Learn more aboutprivacyand how we collect data to give you relevant content. Estate Forms under Rule 74 and 75 of the Rules of Civil Procedure, Rules of Civil Procedure Forms Archive (Obsolete), Forms under the Criminal Rules of the Ontario Court of Justice, Forms under the Criminal Proceedings Rules of the Superior Court of Justice, Solicitors Act assessment forms (non-prescribed), Other documents related to the Rules of Civil Procedure, Prevention of and Remedies for Human Trafficking Act, 2017 forms, Other Documents Related to Family Law Cases, Other documents related to the Superior Court of Justice, Rules of the Ontario Court (Provincial Division) in Provincial Offences Proceedings Forms. 709/21 came into effect on January 1, 2022. WebOn an estate over $50,000, there are no fees or tax payable on the first $50,000 worth of estate assets. will we have to probate his will (live in Manitoba)? You may have read about Transfer on Death or Pay on Death bank accounts. Probate in Ontario is a legal process asking the court to: To make probate applications to the court for probate you will require to submit documents needed as set by the Estates court regulations. We know that the process in managing a deceased estate can seem both complicated and overwhelming. You have actually been only shown the old ways to try to deal with financial issues. Because each provinces rules, approval body, process and costs differ. Estate tax return preparation and filing and all the other activities I have already mentioned above. Ottawa, ON K1G 3, e: info@ontario-probate.ca Travelers Guarantee Company of Canada. The estate trustee must pay Ontario probate fees (Estate Administration Tax) on the value of all the deceased's worldwide property, other than certain exempt assets such as property held jointly with another person and passing to that person by right of survivorship, assets with beneficiary designations, and real property located outside From your article, I understand, or hope that I do, that only assets that arent attached to beneficiaries are up for probate, which would be her house, and one bank account. Heres how to plan your estate, look after your assets after your death.. You may need professional legal help with this issue. 3 0 obj

If the first partner died and left the entire estate to the surviving partner, then probate can be avoided. It is also during the probate process that a Will can be challenged. If you are transferring the house from your fathers name to your name, there would probably be land transfer tax to pay. We acknowledge that Sun Life operates in many Territories and Treaties across Canada. Documents that are required to be filed under the Rules of Civil Procedure can also be filed in hardcopy at the court counter and in some cases by mail or by email. Choosing to not write a Will is not a strategy for avoiding probate. Step 3 The forms will be We can arrange to meet you at this address, or at an address across the GTA that suits you better. Hi Peter, please contact us at [emailprotected] we can put you in touch with a lawyer who may be able to help you. What could happen if your executor doesnt apply for letters probate? t: 1 (888) 995-0075 Thanks so much. Complete the necessary boxes which are yellow-colored. Experts spend their professional lives learning to understand it and give helpful advice. These old ways do not work anymore. Probate is a complex topic. To understand whether or not your Will needs to go through the probate process, you have to understand what happens after you have died. the testator was of the age of the majority at the time of execution of the will and that the will is the last will of testator and has not been revoked by marriage or otherwise. Your car, bank accounts, clothes, jewelry. Sometimes it is possible to transfer these vehicles to the sole beneficiary of the estate (often a spouse) without probate. Hi Bertha, thank you for the comment. This makes no sense, the work is not worth tens of thousands of dollars. Size of the trust will be about $2,000,000. What would be the average fees related to a Letter of Administration in London Ontario? That means that if one partner dies: This scenario can make a lot of sense, both now and after one of you dies. Here are 16 things you need to know when making a will or acting as an executor for someone else.

APPOINTMENT OF There will be a three month grace period for filing the revised forms. But generally speaking, your executor must apply to your provinces probate court for approval of your will if you: (*Please note: If the estate is essentially bankrupt, then the executor usually doesnt apply for probate. Make well-informed decisions with helpful advice. Learn more aboutprivacyand how we collect data to give you relevant content. Estate Forms under Rule 74 and 75 of the Rules of Civil Procedure, Rules of Civil Procedure Forms Archive (Obsolete), Forms under the Criminal Rules of the Ontario Court of Justice, Forms under the Criminal Proceedings Rules of the Superior Court of Justice, Solicitors Act assessment forms (non-prescribed), Other documents related to the Rules of Civil Procedure, Prevention of and Remedies for Human Trafficking Act, 2017 forms, Other Documents Related to Family Law Cases, Other documents related to the Superior Court of Justice, Rules of the Ontario Court (Provincial Division) in Provincial Offences Proceedings Forms. 709/21 came into effect on January 1, 2022. WebOn an estate over $50,000, there are no fees or tax payable on the first $50,000 worth of estate assets. will we have to probate his will (live in Manitoba)? You may have read about Transfer on Death or Pay on Death bank accounts. Probate in Ontario is a legal process asking the court to: To make probate applications to the court for probate you will require to submit documents needed as set by the Estates court regulations. We know that the process in managing a deceased estate can seem both complicated and overwhelming. You have actually been only shown the old ways to try to deal with financial issues. Because each provinces rules, approval body, process and costs differ. Estate tax return preparation and filing and all the other activities I have already mentioned above. Ottawa, ON K1G 3, e: info@ontario-probate.ca Travelers Guarantee Company of Canada. The estate trustee must pay Ontario probate fees (Estate Administration Tax) on the value of all the deceased's worldwide property, other than certain exempt assets such as property held jointly with another person and passing to that person by right of survivorship, assets with beneficiary designations, and real property located outside From your article, I understand, or hope that I do, that only assets that arent attached to beneficiaries are up for probate, which would be her house, and one bank account. Heres how to plan your estate, look after your assets after your death.. You may need professional legal help with this issue. 3 0 obj

If the first partner died and left the entire estate to the surviving partner, then probate can be avoided. It is also during the probate process that a Will can be challenged. If you are transferring the house from your fathers name to your name, there would probably be land transfer tax to pay. We acknowledge that Sun Life operates in many Territories and Treaties across Canada. Documents that are required to be filed under the Rules of Civil Procedure can also be filed in hardcopy at the court counter and in some cases by mail or by email. Choosing to not write a Will is not a strategy for avoiding probate. Step 3 The forms will be We can arrange to meet you at this address, or at an address across the GTA that suits you better. Hi Peter, please contact us at [emailprotected] we can put you in touch with a lawyer who may be able to help you. What could happen if your executor doesnt apply for letters probate? t: 1 (888) 995-0075 Thanks so much. Complete the necessary boxes which are yellow-colored. Experts spend their professional lives learning to understand it and give helpful advice. These old ways do not work anymore. Probate is a complex topic. To understand whether or not your Will needs to go through the probate process, you have to understand what happens after you have died. the testator was of the age of the majority at the time of execution of the will and that the will is the last will of testator and has not been revoked by marriage or otherwise. Your car, bank accounts, clothes, jewelry. Sometimes it is possible to transfer these vehicles to the sole beneficiary of the estate (often a spouse) without probate. Hi Bertha, thank you for the comment. This makes no sense, the work is not worth tens of thousands of dollars. Size of the trust will be about $2,000,000. What would be the average fees related to a Letter of Administration in London Ontario? That means that if one partner dies: This scenario can make a lot of sense, both now and after one of you dies. Here are 16 things you need to know when making a will or acting as an executor for someone else.

These rules do not actually speed up the probate process or make it much simpler or easier for many estates nor do they change the administration of the estate after probate. 15 answers to your will and probate questions. The key variables that affect whether or not a bond is required are: whether Ontario is the first location to probate the estate, whether or not there is a will, if there is a will, whether the executor is named in the will, and where the estate trustee resides (ie. whether in Ontario or in the Commonwealth, or not in the Commonwealth). Posted on. I hope you found how long does probate take in Ontario Brandon Blog post helpful. Or your executor cant do the job? The table also outlines the amendments to the estate court rules that came into effect on January 1, 2022. December 16, 2021. For example, your contingent beneficiaries may be your children or another family member..  Even if a bond would be required under the rules above, a bond is not required if the value of the estate is under $150,000 andif the estate trustee is either the named executor in the will, or whether there is a will or not, the spouse of the deceased (note, in this context spouse can mean either legally married or common law. Without the survivorship clause, your entire estate would pass to your main beneficiary, and incur probate fees, then the estate would be distributed according to their Will, and incur a second set of probate fees. The Rules of Civil Procedure allow many civil court forms to be filed electronically through the Civil Claims Online Portal or submitted through the Civil Submissions Online Portal. Many people do not realize that a probate certificate is not always required in the Province of Ontario. However, your Executor will still have to file your final income tax return (and also possibly pay capital gains taxes on some assets). percentage of your assets, not your income. Even longer if there are challenges to the Will. They may have zero experience in acting as an Ontario Estate Trustee. Provincial probate costs and fee structures vary across Canada. Do not use them prior to their effective date, which is listed in the table below. The technical storage or access that is used exclusively for anonymous statistical purposes. Do you know who can steer me in the right direction? Thank you for your assistance appointment of the person who will act as the executor of the estate. But its important to note that avoiding probate fees shouldnt be your only reason for following a particular strategy. The two non-applicable jurats can be removed from the form. Fortunately, our Wills take account of this situation, but sadly, some do not. @Rt CXCP%CBH@Rf[(t

CQhz#0 Zl`O828.p|OX Executors Checklist As I have stated above, the application for a Certificate of Appointment of Estate Trustee is part of the wider probate process. I understand I can unsubscribe at any time and acknowledge that this email address belongs to me. What would be a reasonable percentage range for such a fee? In Ontario, probate fees are paid for by the estate. This means that if you are the estate trustee, you will be responsible for paying the probate fees. Probate fees are a tax that is levied by the government on the value of the estate. Copyright - Miltons IP - All Rights Reserved 2023. Can you clarify this any further for me? WebProbate is the Court procedure for: formal approval of the will by the Court as the valid last will of the deceased; and. WebLet us help you with the process of managing a deceased estate. 16. This helps in case your primary beneficiary dies before you do..

Even if a bond would be required under the rules above, a bond is not required if the value of the estate is under $150,000 andif the estate trustee is either the named executor in the will, or whether there is a will or not, the spouse of the deceased (note, in this context spouse can mean either legally married or common law. Without the survivorship clause, your entire estate would pass to your main beneficiary, and incur probate fees, then the estate would be distributed according to their Will, and incur a second set of probate fees. The Rules of Civil Procedure allow many civil court forms to be filed electronically through the Civil Claims Online Portal or submitted through the Civil Submissions Online Portal. Many people do not realize that a probate certificate is not always required in the Province of Ontario. However, your Executor will still have to file your final income tax return (and also possibly pay capital gains taxes on some assets). percentage of your assets, not your income. Even longer if there are challenges to the Will. They may have zero experience in acting as an Ontario Estate Trustee. Provincial probate costs and fee structures vary across Canada. Do not use them prior to their effective date, which is listed in the table below. The technical storage or access that is used exclusively for anonymous statistical purposes. Do you know who can steer me in the right direction? Thank you for your assistance appointment of the person who will act as the executor of the estate. But its important to note that avoiding probate fees shouldnt be your only reason for following a particular strategy. The two non-applicable jurats can be removed from the form. Fortunately, our Wills take account of this situation, but sadly, some do not. @Rt CXCP%CBH@Rf[(t

CQhz#0 Zl`O828.p|OX Executors Checklist As I have stated above, the application for a Certificate of Appointment of Estate Trustee is part of the wider probate process. I understand I can unsubscribe at any time and acknowledge that this email address belongs to me. What would be a reasonable percentage range for such a fee? In Ontario, probate fees are paid for by the estate. This means that if you are the estate trustee, you will be responsible for paying the probate fees. Probate fees are a tax that is levied by the government on the value of the estate. Copyright - Miltons IP - All Rights Reserved 2023. Can you clarify this any further for me? WebProbate is the Court procedure for: formal approval of the will by the Court as the valid last will of the deceased; and. WebLet us help you with the process of managing a deceased estate. 16. This helps in case your primary beneficiary dies before you do..  It could be a family member, a lawyer or someone you trust., Read more: How to choose an executor for your estate. If theres no will or executor, the court grants letters of administration.. Its wise to have a lawyer or accountant reliably sort through the fine print of your situation. when youre the executor for someone elses will. They can be filled out electronically, then printed.

It could be a family member, a lawyer or someone you trust., Read more: How to choose an executor for your estate. If theres no will or executor, the court grants letters of administration.. Its wise to have a lawyer or accountant reliably sort through the fine print of your situation. when youre the executor for someone elses will. They can be filled out electronically, then printed.

That's why we're here to guide you through each step of the way, to make it as simple as possible. Probate fees are calculated based on the size of your estate. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. Thank you, Peter. A table comparing the old and new estates forms and describing the changes can be found here. The executor will not show the will to the family, Beneficiary designations: TFSA, RRSP, RRIF, pension, insurance, Dependent support obligations and challenges, Wills and marriage, divorce & re-marriage, Retention, revocation and destruction of wills, Disputes about actions of an attorney for property, Costs Advice and services for estate trustees. Learn more about the costs of our services for probate of small estates under $150,000 here. If any one of these seems familiar to you and you are serious about getting the solution you need, contact the Ira Smith Trustee & Receiver Inc. group today. How long does probate take in Ontario? Brandon Smith is a licensed insolvency trustee and Senior Vice-President of Ira Smith Trustee & Receiver Inc.

Biggleswade Outdoor Pool,

I Like The Way You Move I Like The Things You Do,

Articles W