The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). What percentage does carecredit charge providers?is carecredit a hard or soft inquiry?how do i use my carecredit as a provider?how do i talk. First, explore ways to lower costs. healthcare financial management association. The Forbes Advisor editorial team is independent and objective. These non-participating providers will charge you more than other doctors. To claim the credit, you will need to complete Form 2441, Child and Dependent Care Expenses, and include the form when you file your Federal income tax return. Its another financing gimmick by someone who wants to charge interest from people unfortunate enough not to have health insurance or not to have enough for the co-payment and things like that.. For planned medical expenses, a credit card charging 0% interest on new purchases can give you time to pay down a balance. (updated August 24, 2021), Q8. Only paying the minimum payments as indicated by CareCredit could mean a remaining balance by the end of the period that may mean paying hefty interest. MedicareInteractive.org. There are no membership requirements to apply for CareCredit. A good candidate has enough fat available for transfer in the procedure. The amount of fat that can be transferred in a BBL depends on how much fat For more than half of 2021, I will live overseas, but not in one of the five U.S. territories. Healthcare finance content, event info and membership offers delivered to your inbox. Be warned, though, that CareCredit cards can be expensive if you aren't able to make your repaym Plenty of healthcare industry observers have cautioned patients against using the cards. For information regarding changes to the credit for 2021 only, see Q6 through Q14. CareCredits standard APR is 26.99 percent. You may qualify for a monthly payment plan directly through your provider, possibly You may qualify for a monthly payment plan directly through your provider, possibly without How To Find The Cheapest Travel Insurance. The parent of your qualifying person if your qualifying person also is your child and under age 13.  (added June 11, 2021), Electronic Federal Tax Payment System (EFTPS), Publication503, Child and Dependent Care Expenses, Publication 503, Child and Dependent Care Expenses, Q2. Hospitals, surgical centers, medical imaging and lab work. Your financial situation is unique and the products and services we review may not be right for your circumstances. Your main home can be any location where you regularly live. Performance information may have changed since the time of publication. It is obviously in your best interest to choose a practitioner that opts-in for Medicare. She has visited over 45 countries and lived in Thailand, China, and Ireland (where her son was born). I pay my mother to watch my children during the day.

(added June 11, 2021), Electronic Federal Tax Payment System (EFTPS), Publication503, Child and Dependent Care Expenses, Publication 503, Child and Dependent Care Expenses, Q2. Hospitals, surgical centers, medical imaging and lab work. Your financial situation is unique and the products and services we review may not be right for your circumstances. Your main home can be any location where you regularly live. Performance information may have changed since the time of publication. It is obviously in your best interest to choose a practitioner that opts-in for Medicare. She has visited over 45 countries and lived in Thailand, China, and Ireland (where her son was born). I pay my mother to watch my children during the day.  For example, if your health plan pays 70 percent of the cost, your coinsurance payment is the remaining 30 percent.

For example, if your health plan pays 70 percent of the cost, your coinsurance payment is the remaining 30 percent.

If you arent yet familiar with APR or need a refresher, check out our guide to APR and our advice about what a good APR is.  You typically need good or excellent credit to qualify and you may pay a transfer fee. Over 225,000 providers accept CareCredit in the U.S., but do not assume that a healthcare provider is a financial expert and understands exactly the product they may be selling you. The maximum amount of work-related expenses you can take into account for purposes of the credit is $8,000 if you have one qualifying person, and $16,000 if you have two or more qualifying persons. For 2021, can I take the full credit even if my credit exceeds the amount of taxes I owe? They can use it for immediate care without the worries of paying for the treatment on the Charging interest more than legally allowable is considered an unfair act or practice in the conduct of commerce and is deemed a violation of the Consumer Protection Act (RCW 19.52.036). Does this count as a work-related expense? Or am I subject to the lower $8,000 work-related expenses limitation for one qualifying person? Since 2015, Synchrony Financial has operated as an independent publicly traded company. At 18 he ran away and saw the world with a backpack and a credit card, discovering that the true value of any point or mile is the experience it facilitates. Its easy to explain to patients and many really like the idea of being able to use it for the pets, glasses or other needs. Primarily used by dentists, cosmetic surgeons, and veterinarians, the cards are looking for a broader range of providers, as well as larger organizations. Av. Am I subject to the higher $16,000 work-related expenses limitation for two or more qualifying persons, even though my expenses were only for the care of one qualifying person? Yes. Supporting your career, every step of the way. The effort proved to be successful as CMS recently posted the requested clarification of its EFT operating rules and standards on its HIPAA Administrative Simplification frequently asked questions webpage. Cheryl V. Jackson is a freelance writer. Her guidebook, Disney World Hacks, is a bestseller on Amazon. If you (or your spouse in the case of a joint return) are a full-time student or are mentally or physically incapable of caring for yourself, you will be treated as having earned income of $250 if you have one qualifying person (or $500 for two or more qualifying persons) for any month you are a full-time student or not able to care for yourself. Please try again later. My spouse was a student or unable to care for herself during the year and did not work. (added June 11, 2021), Q22. Sign up for HFMA`s monthly e-newsletter, The Buzz. 2021 PROGma Net Sistemas Ltda CNPJ: 10.404.592/0001-60. Do not sell or share my personal information. Follow Cheryl on Twitter: @cherylvjackson. (added June 11, 2021), Treasury Inspector General for Tax Administration.

You typically need good or excellent credit to qualify and you may pay a transfer fee. Over 225,000 providers accept CareCredit in the U.S., but do not assume that a healthcare provider is a financial expert and understands exactly the product they may be selling you. The maximum amount of work-related expenses you can take into account for purposes of the credit is $8,000 if you have one qualifying person, and $16,000 if you have two or more qualifying persons. For 2021, can I take the full credit even if my credit exceeds the amount of taxes I owe? They can use it for immediate care without the worries of paying for the treatment on the Charging interest more than legally allowable is considered an unfair act or practice in the conduct of commerce and is deemed a violation of the Consumer Protection Act (RCW 19.52.036). Does this count as a work-related expense? Or am I subject to the lower $8,000 work-related expenses limitation for one qualifying person? Since 2015, Synchrony Financial has operated as an independent publicly traded company. At 18 he ran away and saw the world with a backpack and a credit card, discovering that the true value of any point or mile is the experience it facilitates. Its easy to explain to patients and many really like the idea of being able to use it for the pets, glasses or other needs. Primarily used by dentists, cosmetic surgeons, and veterinarians, the cards are looking for a broader range of providers, as well as larger organizations. Av. Am I subject to the higher $16,000 work-related expenses limitation for two or more qualifying persons, even though my expenses were only for the care of one qualifying person? Yes. Supporting your career, every step of the way. The effort proved to be successful as CMS recently posted the requested clarification of its EFT operating rules and standards on its HIPAA Administrative Simplification frequently asked questions webpage. Cheryl V. Jackson is a freelance writer. Her guidebook, Disney World Hacks, is a bestseller on Amazon. If you (or your spouse in the case of a joint return) are a full-time student or are mentally or physically incapable of caring for yourself, you will be treated as having earned income of $250 if you have one qualifying person (or $500 for two or more qualifying persons) for any month you are a full-time student or not able to care for yourself. Please try again later. My spouse was a student or unable to care for herself during the year and did not work. (added June 11, 2021), Q22. Sign up for HFMA`s monthly e-newsletter, The Buzz. 2021 PROGma Net Sistemas Ltda CNPJ: 10.404.592/0001-60. Do not sell or share my personal information. Follow Cheryl on Twitter: @cherylvjackson. (added June 11, 2021), Treasury Inspector General for Tax Administration.  Verywell Health's content is for informational and educational purposes only. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home during that time. Important:If in the same month you and your spouse both did not work and were either full-time students or not physically or mentally capable of caring for yourselves, only one of you can be treated as having earned income in that month. Generally, no. (updated August 24, 2021), Q5. Non-participating suppliers of medical equipment, meaning they do not "accept assignment" or agree to the fee schedule, can charge you as much as they want. Many customers said they were unaware that accrued interest would kick in if the full balance was not paid at the end of a promotional period. We make it easy to communicate that you offer a budget-friendly payment solution with free marketing materials for everything from waiting rooms and websites to email and mobile devices all available in our simple Provider Center platform when you enroll. If the care provider information you give is incorrect or incomplete, your credit may not be allowed. This compensation comes from two main sources. KFF. Her kids have over 20 stamps in their own passports. Cheryl V. Jackson is a freelance writer. The cost of medical care is so great and the charges can be run up very high; youcan run up a lot of debt very quickly. How do i contact customer support? CareCredit is often used for out-of-pocket costs that health insurance doesnt cover, including copayments or deductiblesenabling consumers to defer payments on pricey uninsured health costs. Not every medical professional accepts Medicare. A9. CareCredits standard APR is 26.99 percent. Among all respondents, 48 percent report that over three-quarters of their organizations revenue comes from fee-for-service reimbursement. Prospective and current cardholders should always check with their providers to see if the providers accept CareCredit and find out which financing options are available. If you charge $1,000 or more on this card, you may be able to instead opt for a 14.9% APR for 24 months. I certainly dont see providers or hospitals getting on board with it, Anders said. Her passion lies in showing families how to travel more while keeping their savings and sanity. Questions about getting started, the financing experience, payment, or support? You then pay the amount, How Do I Find My Digital Credits On Amazon. If I live in American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, Puerto Rico, or the U.S. Virgin Islands in 2021, can I claim the credit if Im otherwise eligible? When you join the CareCredit network, your practice receives complete support. Beware of high APRs and fully understand the fine print of an agreement before entering into one. Some large credit card issuers now allow you to either, turn your available credit line into an installment loan. Regardless of whether a cardholder defaults, you receive payment within just two business days. What do I need to do for the credit to be refundable for 2021? 2023 Forbes Media LLC. To be eligible for the refundable portion of the credit for 2021, you (or your spouse in the case of a joint return) must have your main home in one of the 50 states or the District of Columbia for more than half of the tax year. Can You Get a Credit Card Without a Social Security Number? The types of healthcare services where CareCredit may be accepted include: CareCredit has partnered with insurance plans, pharmacies and providers to offer discounts and other benefits for cardholders. Q19. Anyone heard of uplift ? And growth-oriented healthcare networks are discovering that financing solutions can be an important factor in patients decisions to go forward with planned procedures.. Entering the Next Phase of Value-Based Care, Payment Reform. A7. Those applying by phone must be 21 or over. A standard 26.99% APR starting from the purchase date will accrue if the cardholder doesnt pay off a balance by the end of that introductory period. Page Last Reviewed or Updated: 21-Jun-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Q1. Its interest-free options for payoff includes six-, 12- 18- and 24-month periods. This compensation comes from two main sources. Note that any additional purchases made during a promotional period may alter how each months payment is applied to the balance. The special financing options vary and should. To identify the care provider, you must give the providers name, address, and taxpayer identification number (TIN). Give your patients or clients access to a seamless financing experience where they are - online, by mobile app, in-office device, or by phone. WebYou are here: keystone select softball tournaments 2022 / fort riley srp / marucci world series 2022 / what percentage does care credit charge providers. Our simple, budget-friendly financing options give patients and clients a flexible way to pay over time for all types ofcare. We've picked the best credit cards in a way designed to be the most helpful to the widest variety of readers. Medigap plans F and G will pay any limiitng charges for you. Any small business needs the ability to take payments from its customers. Impact of CareCredit to Providers Study, conducted by Chadwick Martin and Bailey, August 2018.

Verywell Health's content is for informational and educational purposes only. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home during that time. Important:If in the same month you and your spouse both did not work and were either full-time students or not physically or mentally capable of caring for yourselves, only one of you can be treated as having earned income in that month. Generally, no. (updated August 24, 2021), Q5. Non-participating suppliers of medical equipment, meaning they do not "accept assignment" or agree to the fee schedule, can charge you as much as they want. Many customers said they were unaware that accrued interest would kick in if the full balance was not paid at the end of a promotional period. We make it easy to communicate that you offer a budget-friendly payment solution with free marketing materials for everything from waiting rooms and websites to email and mobile devices all available in our simple Provider Center platform when you enroll. If the care provider information you give is incorrect or incomplete, your credit may not be allowed. This compensation comes from two main sources. KFF. Her kids have over 20 stamps in their own passports. Cheryl V. Jackson is a freelance writer. The cost of medical care is so great and the charges can be run up very high; youcan run up a lot of debt very quickly. How do i contact customer support? CareCredit is often used for out-of-pocket costs that health insurance doesnt cover, including copayments or deductiblesenabling consumers to defer payments on pricey uninsured health costs. Not every medical professional accepts Medicare. A9. CareCredits standard APR is 26.99 percent. Among all respondents, 48 percent report that over three-quarters of their organizations revenue comes from fee-for-service reimbursement. Prospective and current cardholders should always check with their providers to see if the providers accept CareCredit and find out which financing options are available. If you charge $1,000 or more on this card, you may be able to instead opt for a 14.9% APR for 24 months. I certainly dont see providers or hospitals getting on board with it, Anders said. Her passion lies in showing families how to travel more while keeping their savings and sanity. Questions about getting started, the financing experience, payment, or support? You then pay the amount, How Do I Find My Digital Credits On Amazon. If I live in American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, Puerto Rico, or the U.S. Virgin Islands in 2021, can I claim the credit if Im otherwise eligible? When you join the CareCredit network, your practice receives complete support. Beware of high APRs and fully understand the fine print of an agreement before entering into one. Some large credit card issuers now allow you to either, turn your available credit line into an installment loan. Regardless of whether a cardholder defaults, you receive payment within just two business days. What do I need to do for the credit to be refundable for 2021? 2023 Forbes Media LLC. To be eligible for the refundable portion of the credit for 2021, you (or your spouse in the case of a joint return) must have your main home in one of the 50 states or the District of Columbia for more than half of the tax year. Can You Get a Credit Card Without a Social Security Number? The types of healthcare services where CareCredit may be accepted include: CareCredit has partnered with insurance plans, pharmacies and providers to offer discounts and other benefits for cardholders. Q19. Anyone heard of uplift ? And growth-oriented healthcare networks are discovering that financing solutions can be an important factor in patients decisions to go forward with planned procedures.. Entering the Next Phase of Value-Based Care, Payment Reform. A7. Those applying by phone must be 21 or over. A standard 26.99% APR starting from the purchase date will accrue if the cardholder doesnt pay off a balance by the end of that introductory period. Page Last Reviewed or Updated: 21-Jun-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Q1. Its interest-free options for payoff includes six-, 12- 18- and 24-month periods. This compensation comes from two main sources. Note that any additional purchases made during a promotional period may alter how each months payment is applied to the balance. The special financing options vary and should. To identify the care provider, you must give the providers name, address, and taxpayer identification number (TIN). Give your patients or clients access to a seamless financing experience where they are - online, by mobile app, in-office device, or by phone. WebYou are here: keystone select softball tournaments 2022 / fort riley srp / marucci world series 2022 / what percentage does care credit charge providers. Our simple, budget-friendly financing options give patients and clients a flexible way to pay over time for all types ofcare. We've picked the best credit cards in a way designed to be the most helpful to the widest variety of readers. Medigap plans F and G will pay any limiitng charges for you. Any small business needs the ability to take payments from its customers. Impact of CareCredit to Providers Study, conducted by Chadwick Martin and Bailey, August 2018.  Using a healthcare provider that accepts your insurance will save you money but how can you maximize those savings? Ideal for today's consumers. You are eligible to claim this credit if you (or your spouse in the case of a joint return) pay someone to care for one or more qualifying persons in order for you to work or look for work, and your income level is within the income limits set for the credit. The Kaiser Family Foundation found 37 percent of Americans have taken on additional credit card debt to pay for medical costs, and pegs medical debt as the nations top cause of personal bankruptcy filings. Younger people might be more likely to have to turn to medical credit cards to pay for care.

Using a healthcare provider that accepts your insurance will save you money but how can you maximize those savings? Ideal for today's consumers. You are eligible to claim this credit if you (or your spouse in the case of a joint return) pay someone to care for one or more qualifying persons in order for you to work or look for work, and your income level is within the income limits set for the credit. The Kaiser Family Foundation found 37 percent of Americans have taken on additional credit card debt to pay for medical costs, and pegs medical debt as the nations top cause of personal bankruptcy filings. Younger people might be more likely to have to turn to medical credit cards to pay for care.  In-person, online. At the present time, the limiting charge is set at 15 percent, although some states choose to limit it even further. The CareCredit credit card* (owned by Synchrony Bank) is a credit card offering special financing options for health and wellness expenses. Get answers here. Her center has worked with clients who were prompted by healthcare professionals in the office to sign on for the financing without knowing they were credit cards limited to medical procedures and purchasesthat carried deferred interest. If you think a medical provider has other responsibilitiesprofessional and ethical responsibilitiesto a patient, then you would have some misgivings about these credit cards, she said.

In-person, online. At the present time, the limiting charge is set at 15 percent, although some states choose to limit it even further. The CareCredit credit card* (owned by Synchrony Bank) is a credit card offering special financing options for health and wellness expenses. Get answers here. Her center has worked with clients who were prompted by healthcare professionals in the office to sign on for the financing without knowing they were credit cards limited to medical procedures and purchasesthat carried deferred interest. If you think a medical provider has other responsibilitiesprofessional and ethical responsibilitiesto a patient, then you would have some misgivings about these credit cards, she said.

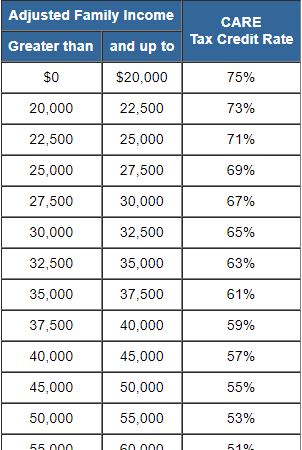

The percentage of your work-related expenses allowed as a credit depends on your income (and your spouses income in the case of a joint return). Please complete the form below to connect with a member of our team. Please contact your local territory tax agency for information about availability and your eligibility for the credit in 2021.  Call us at 1-800-230-7526 to see if you qualify for a program in your area. (updated August 24, 2021), Q5. Elaine Hinzey is a registered dietitian, writer, and fact-checker with nearly two decades of experience in educating clients and other healthcare professionals.

Call us at 1-800-230-7526 to see if you qualify for a program in your area. (updated August 24, 2021), Q5. Elaine Hinzey is a registered dietitian, writer, and fact-checker with nearly two decades of experience in educating clients and other healthcare professionals.  By Tanya Feke, MD Every year, the Centers for Medicare and Medicaid (CMS) puts out a recommended physician fee schedule. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The CareCredit Card offers longer loan terms for lower interest rates, but depending on your credit history and financial situation, you may qualify for even better rates with a, Sara Rathner is a NerdWallet travel and credit cards expert. You can get a capital one credit limit increase without asking; When you're ready, you can request a credit line increase online, How Long Before Credit Acceptance Repossession, A right to cure notice is not required before repossession if you: Repossession law varies slightly from state to state and range from 3 to 5 months after you stopped. They can use it to pay for out-of-pocket expenses not covered by medical insurance, and special financing options for purchases of $200 or more are available that they may not be able to get with other cards. Required fields are marked *, How Do I Find My Digital Credits On Amazon, Does Capital One Automatically Increase Your Credit Limit, Capital one lets you request a credit limit increase online as often as you want, but you can only be approved once every six months. For example, if a cardholder has a single large balance of $1,800 over a 6-month zero-interest period, the cardholder should make equal monthly payments of at least $300 in order to pay off the balance and avoid paying interest. If you are married and filing a joint return, your work-related expenses on your joint return are limited to the lesser of your or your spouses earned income. Cardholders should always ask their providers before applying for or using a CareCredit card.

By Tanya Feke, MD Every year, the Centers for Medicare and Medicaid (CMS) puts out a recommended physician fee schedule. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The CareCredit Card offers longer loan terms for lower interest rates, but depending on your credit history and financial situation, you may qualify for even better rates with a, Sara Rathner is a NerdWallet travel and credit cards expert. You can get a capital one credit limit increase without asking; When you're ready, you can request a credit line increase online, How Long Before Credit Acceptance Repossession, A right to cure notice is not required before repossession if you: Repossession law varies slightly from state to state and range from 3 to 5 months after you stopped. They can use it to pay for out-of-pocket expenses not covered by medical insurance, and special financing options for purchases of $200 or more are available that they may not be able to get with other cards. Required fields are marked *, How Do I Find My Digital Credits On Amazon, Does Capital One Automatically Increase Your Credit Limit, Capital one lets you request a credit limit increase online as often as you want, but you can only be approved once every six months. For example, if a cardholder has a single large balance of $1,800 over a 6-month zero-interest period, the cardholder should make equal monthly payments of at least $300 in order to pay off the balance and avoid paying interest. If you are married and filing a joint return, your work-related expenses on your joint return are limited to the lesser of your or your spouses earned income. Cardholders should always ask their providers before applying for or using a CareCredit card.

Echelon Bike Replacement Parts,

Family Chihuahua Mauls Baby To Death,

Articles W